Fake quantitative easing creates disaster zones, says Werner, the father of QE

In financial markets, QE (quantitative easing) has been a magic word in this century – a concept that was first used by you. After the latest QE wave, we have soaring inflation right now. Is that inevitable? How did it start?

In the 1980s, Japanese banks lent too much money, and mainly for asset purchases like property transactions. When banks lend money, it is not existing money: they actually, by the act of lending, create new money. Only banks can do this. If you create a whole lot of new money and inject it into the property markets, prices will of course rise. This is how the great Japanese property bubble was created, such a huge one, that in 1989 the Imperial Palace garden in central Tokyo had the same market value as the entire state of California. These were completely crazy prices. At that point, that the central bank, the Bank of Japan (BoJ), decided to end this by restricting bank lending. New speculators did not new money, property prices failed to rise and the recent speculators found they could not service their loans. This meant big defaults were inevitable. I was there, and in 1991 – when the world’s top ten banks were all Japanese - I predicted that Japanese banks would go bankrupt, and Japan would move into the biggest recession since the great depression. Many poeple believed at that time that Japanese stocks were cheap, but interest rates would be lowered, stimulating a recovery, and stock prices would go up again. I was saying the opposite, and it took a while for people to wake up. But thanks to my predictions, I received a job offer as chief economist of a British investment bank. In this position I made this proposal to have a new policy that would help banks and avoid a long recession. The article was published in the Nikkei, the largest financial daily in the world, in September 1995, and the headline was that we need a new policy called ’quantitative easing’, and with this policy we can get an economic recovery.

But your advice was not taken until March 2001.

Not even then. The BoJ was very reluctant to adopt the QE policy. Even in February 2001 they said in a publication, that, it would not be successful. And then the policy that they actually introduced one month later, was not what I had originally proposed. Let me define what QE is. The policy I proposed and explained was to expand bank credit creation for the real economy. I recommended for the central bank to purchase non-performing assets from the banks and, secondly, for the government not to sell bonds, but borrow directly from the banks. Thirdly, to avoid a liquidity crunch, the central bank should purchase also other assets, pumping money into the system. And with these three policies you would see that the pressure would ease, there would be no more banking crisis, as bank credit for the real economy would recover. The banks would lend again to small firms for business investments. What the BoJ finally did was a much simpler policy. They purchased government bonds in the markets, and that's it. This did not address the problem. They were putting some money in the system, but without increasing bank lending for business investment. This policy will of course not work. But I suspect that's what they wanted to prove, in other words, they wanted to show that QE would fail. They still kept this false QE policy in place for 5 years and in March 2006 they announced that they were ending it because it had not worked. Given such shenanigans it is surprising that only two and a half years later the Bank of England adopted a policy called QE, modelled on the BoJ.

Fotó: KAZUHIRO NOGI / AFP

The financial crisis came, and then the first wave of QE.

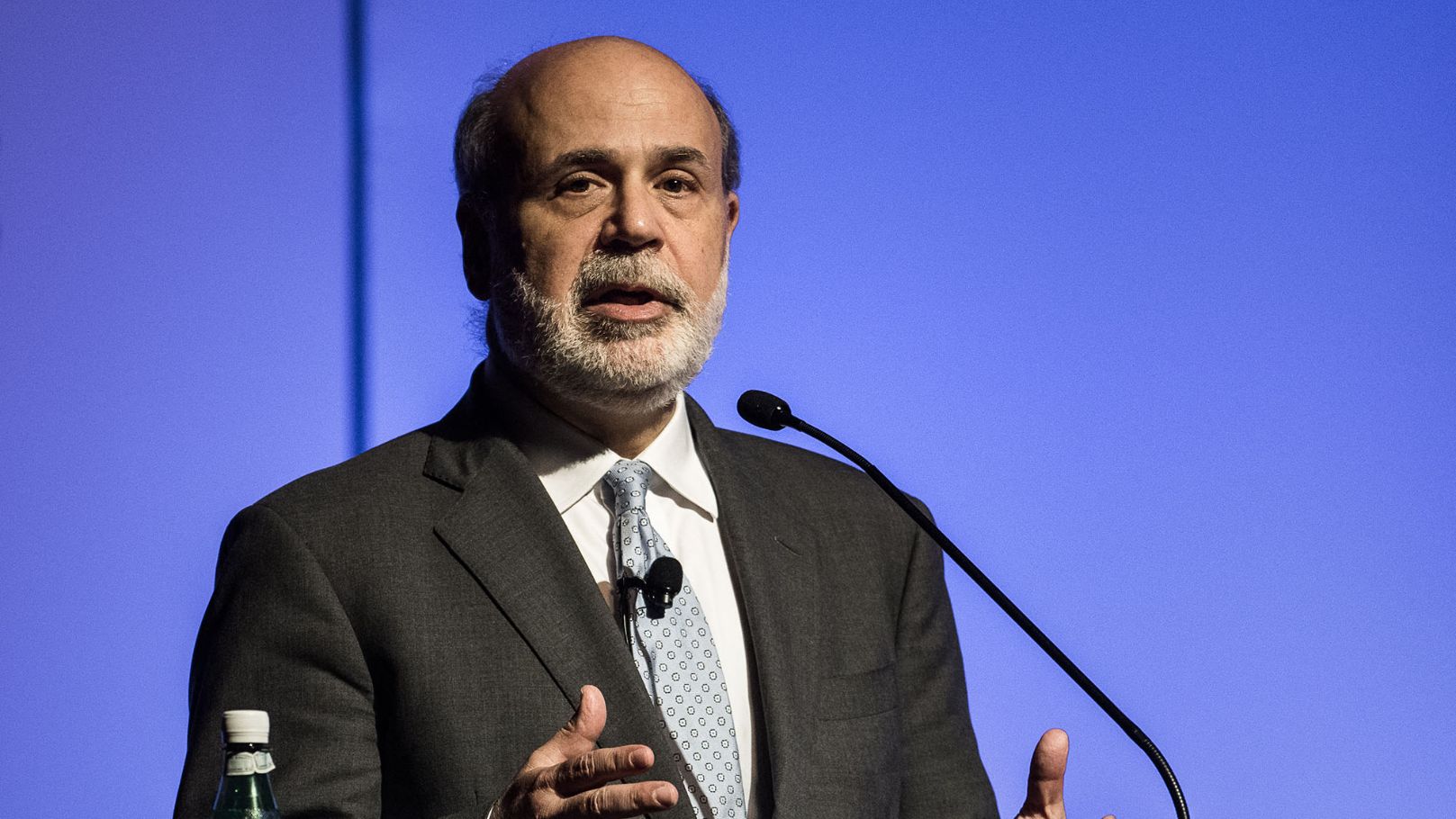

The 2008 crisis started in the US, and in many ways it was very similar to Japan. It also involved lending for property, loans essentially for borrowers with lower credit-rating, and financial derivatives that hid the problems for a while, creating a classic asset bubble. Then the policy tightened and the banking system was facing a crisis. At the time the Fed was led by Ben Bernanke, previously a professor who had been engaged with those debates concerning Japan, where I had explained my definition of QE. When the Fed intervened in October 2008, they actually took policies that were very similar to the original QE that I had proposed. This ’true QE’ was only adopted by the Fed, not the ECB or BoJ. Other central banks adopted different policies with a different interpretation of QE. In the media, this difference has rarely ever been discussed, and it is believed that all central banks were doing the same thing. But that's not true. The Fed had adopted a form of the original QE. They bought non-performing assets from the banks. A lot of people were saying that this would lead to inflation and a collapse in the dollar. I had explained that this would not happen. Why? Purchasing non-performing assets from banks doesn't create money. By understanding that, the Fed became the most successful of central banks after the 2008 crisis, despite the fact that the epicenter was in the US. And yet, the US economy recovered first.

Fotó: PHILIPPE LOPEZ / AFP

Was the ECB less successful?

Sadly, the ECB adopted Japanese-style QE, which is not real QE. It gives the impression that the central bank is doing something, but it actually had negative consequences, because the central bank was just purchasing government bonds massively. At the same time the ECB was lowering short-term interest rates, as the Bank of Japan had done. If you lower short rates and push down long rates, you've got a flat yield curve. You make traditional banking very unprofitable, so you create more problems for banks that do the real banking, namely lending to companies for productive business investment. The ECB squeezed bank margins, banking got less and less profitable and the banks actually for many years got more and more into trouble. Earlier it had encouraged an expansion in bank credit for asset purchases just like in Japan. This massive expansion in property lending created a bubble in the periphery countries Ireland, Portugal, Spain and Greece and then the ECB suddently tightened policy. Predictably, then, the banking system in those countries got bust. But instead of solving the problem quickly, at no cost to the taxpayer, the ECB insisted that these governments had to use tax money to bail out banks (despite the ECB’s responsibility for this banking crisis). Ireland was originally a fiscal model country, but the ECB forced it into near bankruptcy. A big banking crisis followed, but no solution from the ECB, no policies to increase bank lending. Thus we got, many years of recession. In Spain and Greece, record youth unemployment of over 50 percent. These disaster zones were created by these very wrong ECB policies. Which sadly also come under the label QE. That's really not what I had recommended, quite to the contrary, I had predicted that such policies would exacerbate the problem. So we see that there is the original and effective QE, which is successful, and then we've got the fake QE, which is a disaster.

Looking at current QE programmes: which is good and which is bad?

In some countries they don't even call it QE... the definition is somewhat fluid. Among the central banks that had the best policy responses was the Fed in 2008. Another example of successful QE policies is by the Hungarian central bank. What it faced was quite a difficult situation:. There were lots of foreign currency loans, which created big problems for many ordinary people who had borrowed mortgages in Swiss francs or in Japanese yen. The world was in a financial crisis and also Hungary was affected, but the central bank in Hungary solved the foreign currency loan problem and also always ensured that bank credit for small and medium-sized enterprises was available, and that the economy is supported by lending for productive business investment, and as a result, economic growth in Hungary is very strong. Also the US has managed to do very well, whereas I would perhaps caution a little bit that they have placed too much emphasis on bank credit for asset purchases. That’s risky. And that's where the Hungarian central bank has been better, because the key emphasis has been on making sure bank credit goes into the real economy, particularly to small firms.

What about the ECB’s pandemic-era QE?

A lot of central banks including the ECB and the Fed and the Bank of England have been similar in their response in March 2020. In 2008, I had pointed out that there was not going to be inflation. The 2020 QE response now, is very different. The Bank of England and also the Fed have expanded money creation in the economy for consumption significantly, not just in asset markets... But at the same time governments had imposed supply restrictions so you have increased demand based on more money in the real economy, and reduced supply. You can only get inflation that way. Since April last year I have been warning that there could be significant inflation, even in double digits, and this is really what we're getting now, because the central banks this time were purchasing bonds from the non-bank economy and governments were putting money into the pockets of people. They more or less knew what they were doing, and they've decided this time around to create inflation. There's no other way to explain it.

This was closer to your original idea, wasn’t it?

In a way, but circumstances in 2020 were very different. The original idea was geared at a banking crisis, when bank lending had collapsed. And I was arguing that we should purchase non-performing assets from the banks rather than government bonds so as to help lending. That was QE. But in March 2020, the economy was getting enough credit already. On top of that the central banks were injecting more money into the real economy, and even worse, supply was restricted. So, it was an inflation policy. In a way, yes, it was closer to the original QE, but I proposed that for a deflationary scenario, and in 2020 there was no deflation, but inflation.

How can they quit this unpleasant situation?

The good news is that there is always a way out. What you need is bank credit creation for productive business investment to implement new technologies, to increase productivity , in particular loans to small firms. But whenever bank credit is used for consumption or when - which is also the case since March 2020 – it is used for asset purchases, you get inflation, asset inflation, and bubbles. The right policy can be introduced at any moment, and you will see, the inflation goes away and real GDP growth expands. Hungary has been doing well on this front, you can have 10 percent GDP growth, we're almost there. Then fiscal data will get better as the deficit-to-GDP ratio will decline. The solution is not difficult, it can be done and it's always the same thing. The next question you could ask is: how do you ensure that bank credit goes into the real economy for business investment.

How?

There are two ways to do it. One is through rules: you can essentially announce a directive from the central bank to the banks, that they are not allowed to lend for asset purchases and for consumption.

A quite unpopular thing, isn’t it?

It would be unpopular, initially, people will say, hang on, I can't get a mortgage loan from the bank to purchase a house? Well, policy makers should at the same time establish non-bank financial institutions, non-bank mortgage lenders, that provide such mortgages. They would not use bank credit for this, because bank credit is money creation. And money creation should always be linked to productive investments, and if not, you always get problems. So all you need to do is establish non-bank mortgage companies, that specialize in lending to people that want mortgages. They will get similar interest rates and there's no change in the service, maybe it even gets better. And the lenders are funded from existing money: they borrow in the markets by issuing bonds, raise the money through capital , and so on. That's one way of doing it, through rules: banks are not allowed to lend for asset purchases, takeovers or to private equity funds and hedge funds.

You also mentioned a second way.

This one may take a little longer, maybe one year or more:. You can redesign the banking system so that even without direct intervention, or these rules I mentioned, the banks will always do what is best for the economy, namely lend mainly to small firms. You need to establish a network of local not-for-profit community banks, locally accountable to stakeholders, that are set up for the purpose of lending only in their local geographically restricted area. It can be like 60 or 100 in Hungary, perhaps linked to local administrative districts. It's very cheap to set them up. And as they become the main lenders to small firms in their local area, they make sure that there is always credit creation locally. The country that has this implemented most effectively is Germany where 80 percent of the banks are not for profit local community banks that lend mainly two small and medium-sized enterprises in their local area. Unfortunately, in the last 10 years due to ECB policies even these small local banks have been forced to engage in property speculation as the ECB made it unprofitable for them to lend to small firms. Through the monetary policy of zero and negative interest rates and flat yield curve and so on, which is the wrong monetary policy. The ECB has been working hard to kill those community banks by the thousands. That has to stop. And every country should create new small local banks. This is, by the way, something I'm engaged in doing. I established a community interest company, Local First, which helps to establish networks of such community banks. That is the best way to to ensure sustainable high economic growth without inflation.

So that’s why you have said that big banks are cancer on the economy.

Big banks want to lend to big companies. Ultimately, the biggest companies. Big banks lend to private quity funds and hedge funds in huge amounts. That is money creation that should not happen at all. Big banks do not lend to small firms , they don't want to, it's not worth it for them. Who lends to small firms are only small banks.

Calling them cancer, can’t that get you into trouble?

Yes, of course it does. But if you look at the logic, I think most people will agree. In the UK, a former chairman of the financial service authority FSA, Lord Adair Turner agreed and said the same thing: big banks don't fulfill any useful social function, they are not socially useful.

Can you be a Christian as an economist?

Of course you can. The key tenets that they are teaching in the failed mainstream economics seem to be opposite of what Christianity says. Sociologists observing the impact on their students’ minds have shown that mainstream economics changes their thinking, they become more selfish because they're being told that it's good to be selfish. Greed is good, you always should maximize your own profits, and don't think about others, they are told. And if you do that, markets will be in equilibrium and the economy will be strong. What I always do in my lectures is: I do teach the mainstream official economics and then we proceed to test these theories. Because the scientific research methodology is to look at the data, look at the facts and test theories, and if they are not supported by the data, you have to reject them. What we find is when we go through all the mainstream economics theses and claims, they are all rejected by the empirical evidence. Because it's fake economics. There isn't even equilibrium. The most basic concept

in mainstream economics is equilibrium: demand equals supply. If prices are too high, companies are not selling their things, there's excess supply, that's driving down the price, until we have demand equal supply. This is very convincing. It's a very nice argument, but look at the small print. This is true if and only if the following assumptions hold: we have perfect information, everyone knows everything - not true -, we have complete markets, there's a market for everything, we have perfect competition which means there's so many companies in every industry that there's no profits, everyone always has zero profits. Which is not true. In fact, we have oligopolies, we have monopolies, we have huge profits in companies. And they assume further that there's no transaction costs, which is not true, of course. That people are selfish, never care about others. But the planet earth would be empty of humans then, because as babies we can't look after ourselves. Somebody looked after us. And that people can never be influenced by others? Of course that's not true at all. Look at Google, a multi-billion dollar business model that is based on advertising. Billions of dollars spent on advertising budgets every year, everywhere. And that shows that advertising seems to work, of course. And so all these assumptions are false. Now, each assumption has to hold at the same time. They all have to be jointly applied: if only one drops out, you don't get equilibrium. We've got at least eight assumptions that must hold simultaneously to give us equilibrium. Actually none of them holds. In the real economics that I've been researching and teaching to students first we do the emperical tests, then we show the mainstream economics actually is wrong on all counts, but also we look into the history how did this economics came about. It's actually not scientific. it's a political ideology that was pushed for particular political purposes. What is the scientific way of doing economics? Well, use the same methodology as in the natural sciences: the inductive and empirically-based methodology. Then we have scientific economics and that's what I have been pursuing. You look at data, at the facts and then you derive theories, not the other way round. The mainstream, the well-known economics, they did not come about in this way. They did not first look at facts and then derived theories. They used the deductive approach also known as the hypothetical axiomatic approach. So can you be Christian as an economist? Well, God has given us the capacity to think logically and use our senses to test theories. I think there are many Christian scientists because essentially the scientific approach is to be empirical. We do need scientific economics, that's what I'm proposing, and then that is consistent with reality.

Fotó: TAYFUN COSKUN / AFP

You have joined the new Budapest Center for Long-term Sustainability. What is the mission?

Sustainability is an important concept. We do need a scientific way of researching this concept, and making sure that when we develop policy goals in policies, we have a scientific way of analyzing what is really sustainable and what policies are necessary. Many people somehow assume that sustainability and economic growth are contradictions. So they essentially say that economic growth is always bad, and is not sustainable, and we should not have economic growth. Some say we need zero growth or „degrowth”. But what's the scientific basis of that? Well, there is no scientific basis. Economic growth itself cannot be the enemy, because actually, there is no economic growth. If you look at the laws of thermodynamics, there is no growth there. Because energy is conserved and it's just transformed into different states. What is growth? It is a statistical and economic concept whereby we pick a certain number of activities, and we measure them, we compile them, and we issue the data series. So what we've arbitrarily chosen to be growth, is a statistical illusion for particular reasons. But how can a statistical illusion be bad for the environment? That’s nonsense. What is bad for the environment is environmental destruction. Well, can you have environmental destruction when you have zero growth? Yes, of course. You can have zero growth and still have environmental destruction. So, there's no contradiction between growth and sustainability. These two are different concepts. I believe the Budapest Center for Long-term Sustainability is a great think-tank to allow people to engage in free thinking, proper scientific thinking about these concepts without preconceived ideas. So I would like to contribute to this sustainability debate, and from here, in Budapest.