The ECB must continue to show its teeth – Austrian central bank governor

The European Central Bank needs more evidence to see that inflation is declining towards its medium-term target, its decision-maker Robert Holzmann, the Governor of the Austrian central bank told Világgazdaság.

- Mr. Holzmann, in the eastern part of the Union inflation rates are even higher than the Eurozone average. Do you think this also means that it will also be harder for these countries to fight back inflation, including Austria, where the price increases are also relatively high?

- The current wave of inflation is certainly a historic event in terms of its magnitude and regional scope. Central, Eastern and Southeastern European (CESEE) countries did indeed experience higher inflation rates than the euro area on average. In part, this can be explained by stronger price increases of energy and food, two items that weight especially heavily in the region’s consumption baskets. At the same time, CESEE countries are highly open

economies, where exchange rate fluctuations – as experienced after Russia’s invasion of Ukraine – can have a profound impact on price developments.

Those specifics can substantially amplify global price pressures just as much as they can dampen them.

Furthermore, in some countries fiscal policy added to the price pressures. Monetary policy must therefore always be tailored to accommodate the structural specifics of a given economy, but in principle, the CESEE central banks have all the necessary tools and the resolve to successfully pursue their inflation targets. CESEE countries are already much further ahead in their hiking cycles than most advanced economies, as they reacted early to rising price pressures. They were successful in taming inflation expectations, stabilizing exchange rates and reducing the risk of second round effects.

This prudent monetary stance already paid off, as inflation rates – supported by lower global energy prices – have recently started to decline in many countries of the region.

In Austria we expect inflation to remain above the EA average over the short and medium term. The main reason is a tight labor market and second round effects of past inflation peaks on wages.

- Still in the East: Eurozone membership has not proved to be a shield against high inflation, while memories of the Eurozone crisis are still vivid in the region. Do you think arguments voiced in the region's biggest economies, that entry to the Eurozone should come in a later stage, - after higher living standards are reached - are valid, at least in part? The question is again on the table in the Czech Republic right now, and may also become part of the Polish election campaign.

- Euro area membership has some obvious benefits, especially for countries with strong trading relations with the euro area and/or a high degree of euroization. Euro area membership can also shield small and open economies from international headwinds, especially when it comes to international financial market turbulences, including temporary outlflows, as experienced all too often during the past 15 years.

The track record of the CESEE region, however, shows that countries can perform well inside as well as outside the euro area.

Poland, for example, was the only EU Member State that sailed through the financial crisis without experiencing a recession. As so often, it’s a question of individual structural features that enable a smooth and beneficial participation in the currency union. To ensure that all the necessary preconditions are met, countries are not only obliged to adhere to the nominal convergence criteria, but they are also required to demonstrate macroeconomic stability, including a supportive business environment with efficient economic structures and public institutions and a sound fiscal policy. Countries should and in fact can only enter the currency union, once these preconditions are met.

It also needs to be noted, however, that once the criteria are met, countries are obliged by the Treaties of the European Union to adopt the euro.

As far as living standards are concerned, let me just note the following: most EU countries outside the euro area, especially the Czech Republic, today have a higher GDP per capita than the previous euro applicants from CESEE.

Czechia, in fact, has a higher GDP per capita than Spain.

- Do ECB rate setters take into consideration the impact of their decisions on non-Eurozone economies as well, at least in the back of their mind?

- Our mandate clearly states to ensure price stability in the euro area, such that we base our decisions on the state of the euro area’s economy. However, it is important to acknowledge that this state is not only influenced by the euro area's own economy, but also by the global developments of our trading

partners within the European Union and beyond. But we are well aware that in an interconnected world, our actions do not only affect the euro area but also other non-euro area economies.

So, in a nutshell, we indeed monitor the financial and macroeconomic conditions of a wide range of non-euro area countries and assess the potential spillovers and spillbacks of our actions. But ultimately

our primary focus remains on the price stability in the euro area.

- Europe has been staggering from crisis to crisis for years, do you agree? With that in the background, is it possible at all to bring down inflation to the target, while also having meaningful economic growth?

- The continued impact of the COVID-19 pandemic and the reverberations of the war in Ukraine indeed represent significant challenges for policymakers in Europe, both in the political and the economic spheres. These shocks continue to influence economic developments. Yet, the ECB Governing Council has reacted promptly and has been tightening monetary policy since December 2021, and intensified with sharp rate increases since July 2022. We closely monitor the situation, and we are determined to take all the necessary steps to bring inflation down to 2 percent in the medium term.

Without prejudice to our primary objective of price stability, we will certainly continue to support the general economic policies in the EU as per our secondary objective – and this naturally includes the Union’s work towards achieving balanced economic growth.

- You received the Lamfalussy award for your life work. If you look back, do you have any particular moments, achievements - or even difficulties, if you had any - which are in the warm corners of your heart?

- Yes, I had such special moments, and the memories go back to the late 1980s when I worked for the IMF but was asked to work on fiscal issues in then

communist and later transition economies of the region

including Hungary and Poland.

Being involved in major adjustment programs in most countries of the region and helping in their transition towards market economies and democracies has been very awarding and hard warming when seeing progress and liberty. Later examples include my involvement in the countries during the East-Asia crisis in the late 1990s and the successful contribution of creating in Korea the by now third largest public fund in the world with the World Bank.

Or the translation of risk management considerations of the financial sector into an operational concept of designing and implementing social protection programs as social risk management in developing countries,

nowadays a development paradigm.

And last not but least, most recently when I worked in the countries of the Gulf Cooperation Council in order to successfully explore and identify limitations to their national growth and work on solutions to reduce them.

- Do you think there are still 50 basis point interest rates hikes ahead? Will the ECB's decision-making bodies maintain their resolve to fight inflation hard, while there are risks to economic growth? What do you think the greatest economic risks are that Europe, your country and Hungary will face this year?

- The ECB Governing Council will continue with a data-dependent meeting-by-meeting approach and further rate hikes are very likely as inflation is still strong across Europe. It is very important to stick to the course and maintain a sufficiently restrictive policy stance to ensure a timely return of inflation to the 2 percent medium-term target.

The main risk for Europe continues to be the war in Ukraine.

In addition to the growth risks that would be associated with an intensification of the war, the further development of energy prices and thus the further development of inflation will pose a major challenge for monetary policy in the near future. In addition, there are two other global short-term risk factors: First, a possible US recession would have a significant negative impact on Europe and on financial markets world-wide.

Second, the end of the zero-COVID strategy in China and the return to national and international mobility promises major demand and supply effects with potential economic growth but also inflation risks.

The biggest risk in Hungary seems to be a further prolongation of the dispute with the EU Commission about cohesion and RRF funds which may even lead to a definite loss of grants to the country. Some uncertainty is also connected with the various price and interest rate caps which the government has introduced, and their potentially distortionary effects.

- Mr. Holzmann, stock markets reacted with a rally to Thursday's ECB rate hike and comments. Do you think that reflects overt optimism that the ECB will pause its rate hike cycle soon?

- We cannot and should not interpret daily market movements, but rather continue monitoring Euro Area’s inflation developments in order to make data-dependent and meeting-by-meeting decisions which will bring inflation down to our definition of price stability in the medium-term.

- Do you think that the ECB should differentiate itself, in rhetoric or deeds, from the Fed and the Bank of England, which in the perception of markets have become more dovish than earlier?

It is crucial to acknowledge that the Euro Area has its own inflation and economic dynamics, distinct from those of the US and UK. Consequently, the monetary policy decisions are shaped by different macroeconomic conditions and may differ accordingly.

In my view, the current macroeconomic fundamentals in the Euro Area do not warrant a more dovish stance,

which resulted in to the decision of an interest rate hike of 50 basis points.

- Do you expect more rate hikes beyond the next one already signalled? One, or even more?

- As we stated in our latest monetary policy decisions last week, the Governing Council will evaluate the subsequent path of its monetary policy following the March meeting. We will abide by our decision to be data-dependent and to follow a meeting-by-meeting approach.

- What would convince you that the job is done, and inflation is safely on track towards meeting the target?

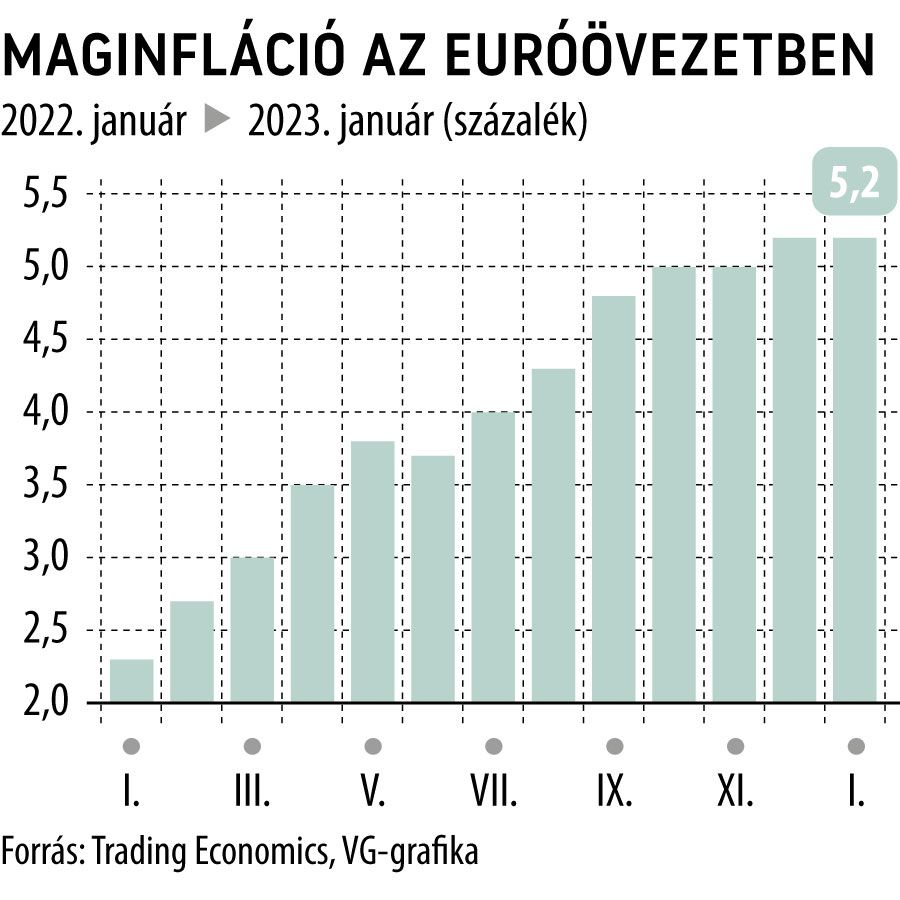

- Monetary policy must continue to show its teeth until we see a credible and persistent convergence to our inflation target.

My view is that as long as core inflation isn’t peaking, changes in headline inflation alone should not drive changes in our determination.